Analysis

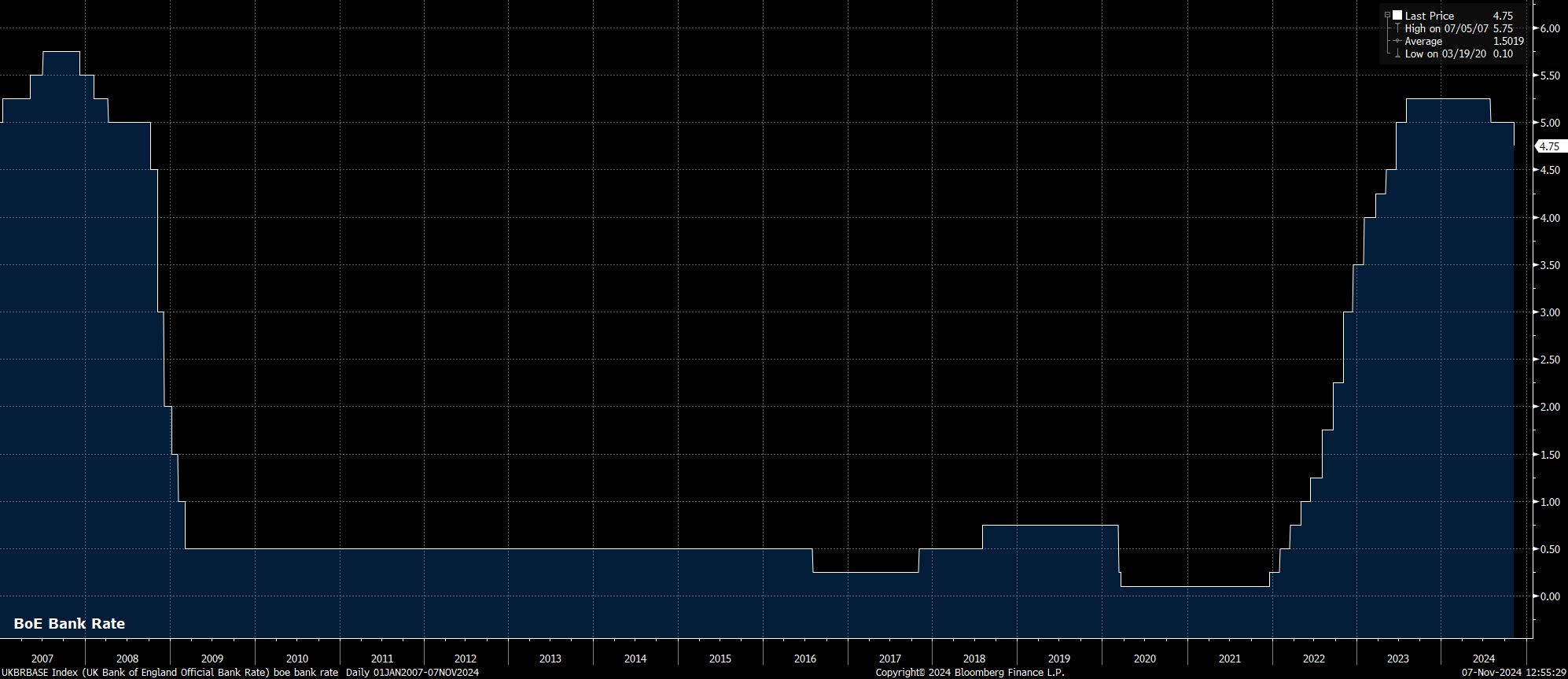

The Bank of England delivered this cycle’s 2nd Bank Rate cut at the conclusion of the November meeting, with the MPC voting in favour of a 25bp cut, taking Bank Rate to 4.75% continuing, as previously outlined, to gradually remove policy restriction, and move rates back to a more neutral setting.

In contrast to this cycle’s first cut, in August, which was voted through by the narrowest possible 5-4 margin among MPC members, the vote split this time around was considerably more straightforward. This time around, 8 MPC members voted in favour of a 25bp cut, with just one – external member Mann – preferring to hold rates steady. Clearly, recent data, particularly on inflation, has given the MPC’s hawks sufficient confidence to begin moving to a less restrictive policy stance.

Importantly, the vote split means that the MPC’s ‘core’ – the Governor, his Deputies, and the Chief Economist – are also now all aligned on the appropriate course of monetary policy.

Accompanying the 25bp cut, the MPC provided forward guidance, which was little changed from the prior meeting, in September. Consequently, the Committee noted that a “gradual” approach to lowering rates remains appropriate, and that policy still needs to remain “restrictive for sufficiently long” in order to eradicate persistent price pressures. Furthermore, policymakers reiterated that a meeting-by-meeting approach would continue to be followed in determining the appropriate policy stance.

Governor Bailey broadly reiterated these sentiments at the post-meeting press conference, while offering relatively little additional information on either the economic backdrop, or the policy outlook. Safe to say, the presser was one for the purists, and might well act as a good cure for insomnia.

Besides the statement, and presser, the November meeting also brought the Bank’s latest Monetary Policy Report, including the latest round of economic forecasts.

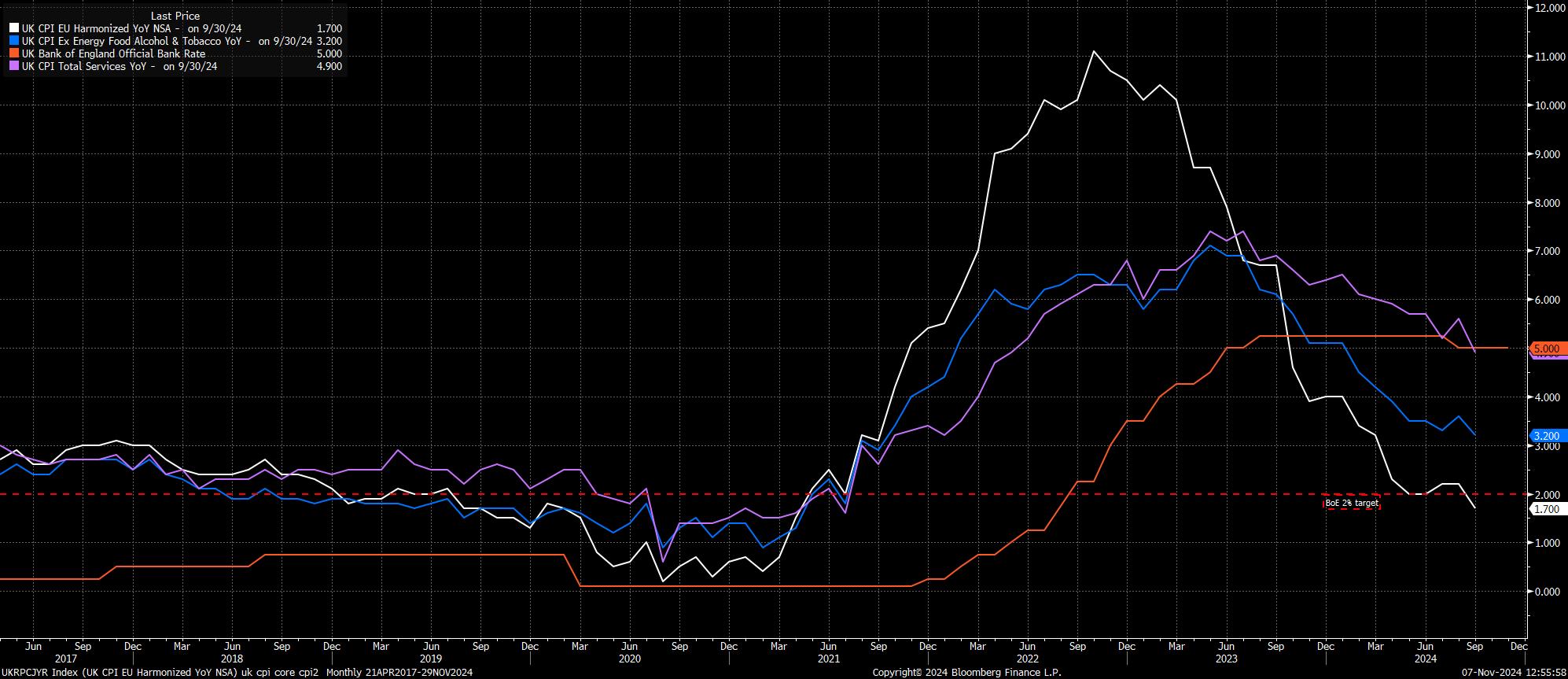

On inflation, reflecting last week’s expansionary Budget, as well as a more dovish market-implied rate path at the time of forecast collation, the profile was revised notably higher, to the tune of around 0.5pp at its peak. Consequently, headline CPI is now seen at 2.2% in the final quarter of 2026, before falling to 1.8% in 2027.

With this forecast conditioned on the market-based rate path, the BoE are implicitly signalling to financial markets that too great a degree of policy easing is presently priced in.

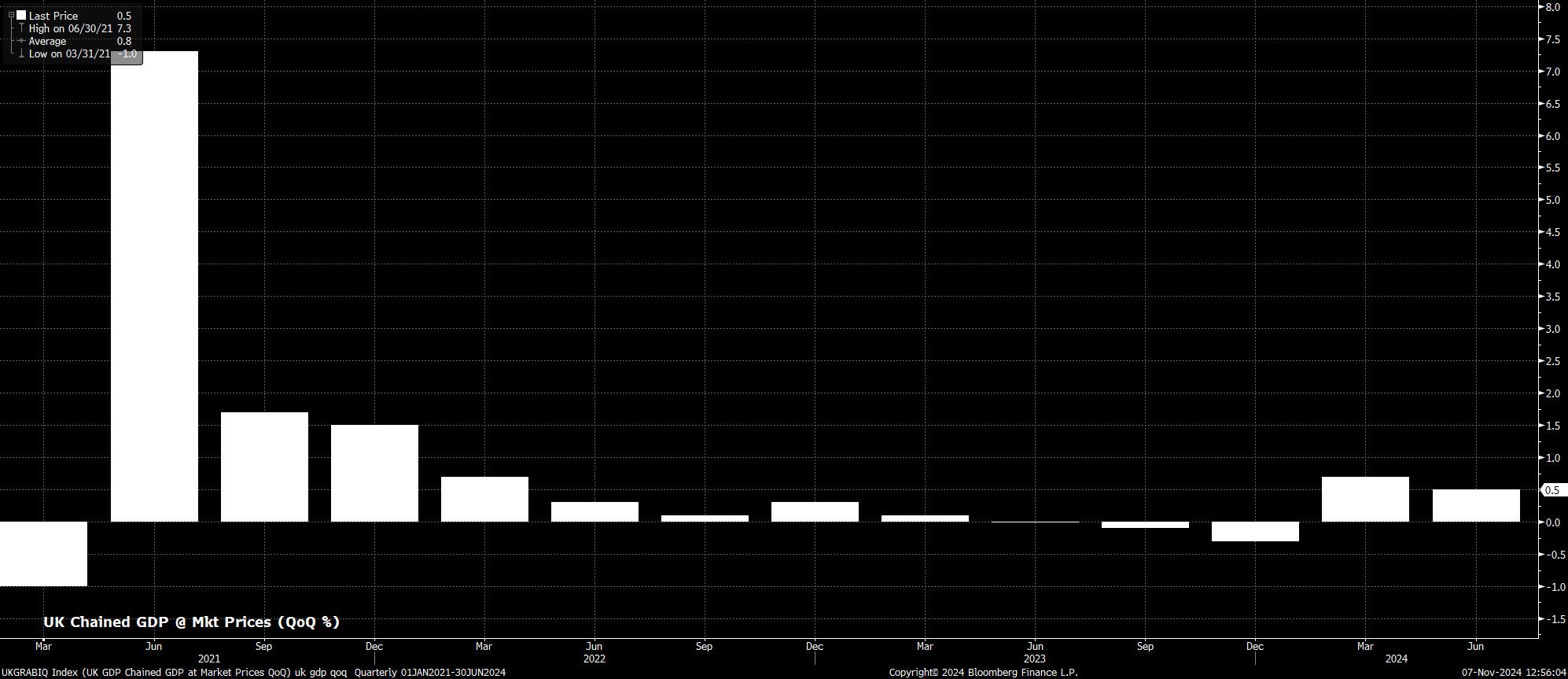

Meanwhile, in terms of economic growth, the Bank view the economy growing by an annual rate of 1.7% this year, and next, before growth moderates to 1.1% in 2026.

Importantly, the Bank’s forecasts do not include the market reaction to the Budget, being based on average market prices in the 15 working days prior to 29th October. Consequently, were the recent market reaction to be accounted for, the GDP profile would likely be substantially more pessimistic.

For financial markets, the November MPC decision, and forecast round, was broadly in line with expectations. Consequently, the subsequent market reaction was relatively muted, albeit marginally hawkish.

As such, the GBP rallied, with cable gaining around 20 pips, climbing towards the 1.2950 mark, benefitting from a sell-off in Gilts, led by the front-end of the curve, where 2year yields rose by around 3bp from pre-release levels. Equities, meanwhile, slid modestly, with the FTSE shedding around 0.2% over the BoE announcement.

_2024-11-07_13-08-37.jpg)

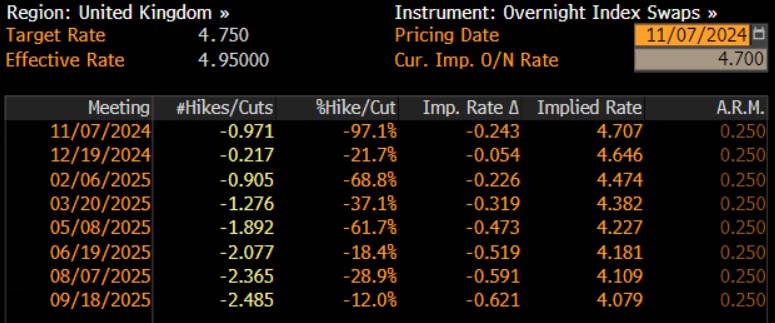

On the whole, despite expectations that the Bank might quicken the pace of policy normalisation in Q4, recent uncertainty on the inflation outlook, brought about by the expansionary Budget delivered by Chancellor Reeves last week, will likely see the ‘Old Lady’ continuing to plot a relatively cautions course, at least for the time being. As such, today’s Bank Rate cut is likely to be the last of the year, as the MPC continue to pay close attention to incoming data, particularly focusing on the persistence of underlying price pressures within the economy.

The next 25bp Bank Rate cut, then, is likely to come in February, in conjunction with updated forecasts. If, at that stage, policymakers have greater confidence in the disinflationary path being well-embedded, the pace of normalisation could well quicken through the early part of 2025. Quarterly cuts, though, remain the base case for now.

Though this outlook is somewhat more hawkish than that of other G10 central banks, such as the FOMC and ECB, hawkish policy divergence alone is unlikely to be enough to convincingly underpin the GBP. This is particularly the case if, as at present, the FX market remains squarely focused on relative growth dynamics, where the UK’s anaemic economic prospects put the pound at a substantial disadvantage to peers – especially considering continued US economic outperformance, a theme which is highly likely to persist into the second Trump Administration.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.